Average Completion Time

1 MonthAccreditation

5 CPD HoursLevel

AdvancedStart Time

Anytime100% Online

Study online with ease.

Unlimited Access

24/7 access to lectures.

Low Fees

Low and easy to pay online.

Advanced Professional Certificate Courses

These are short online certificate courses of a more advanced nature designed to help you develop professionally and achieve your career goals, while you earn a professional certificate which qualifies you for the appropriate continuous professional development (CPD).

Advanced Professional Certificate in Investment Analysis

The Advanced Professional Certificate in Investment Analysis aims to equip the learner with the key concepts of financial instruments traded on the market.

The course will enable the learner to analyze different financial statements using the tools and methods of financial analysis and generate and evaluate different financial investment options. The learner will be equipped with the knowledge and skills to manage the investment portfolio.

Learning Outcomes

Introduction to Investment Analysis:

- Understand the difference between direct and indirect investments and the advantages and disadvantages of each in terms of risk and return.

- Learn the key measures of return and risk used in investment analysis, including the expected return, standard deviation, and Sharpe ratio, and how to calculate them.

- Explore the determinants of the required rate of return, including risk-free rate, market risk premium, and beta, and understand how these factors affect investment decisions.

- Gain a solid understanding of correlation and coefficient of determination and how they are used to measure the strength and direction of the relationship between two assets.

- Dive into the concept of returns, including the different types of returns, such as capital gains, dividends, and interest, and how they impact investment analysis and decision-making.

- Discover the effect of diversification on investment risk and how to construct a diversified portfolio that balances risk and return.

Analysis of Bonds, Forward and Futures:

- Understand the fundamentals of bond market analysis, including the different types of bonds and their characteristics.

- Learn about the advantages and disadvantages of investing in bonds and how to assess whether they are the right investment option for you.

- Gain in-depth knowledge of the various classifications of bonds, such as government, corporate, and municipal bonds, and how they differ from each other.

- Discover the importance of macro-level analysis in bond investment, including factors such as interest rates, inflation, and economic indicators.

- Learn about the concept of options and futures and the role they play in financial markets and investment strategies.

- Understand the concept and uses of swaps, including interest rate swaps and currency swaps, and how they can be used to manage risk and optimize investment returns.

Stock Investment and Portfolio Management:

- Understand the concepts and applications of Economic, Technical and Fundamental Analysis in stock investment.

- Explain the Industry Life Cycle model and its impact on portfolio management decisions.

- Explore and analyze the Tools of Technical Analysis used in stock investment.

- Identify the Objectives of Portfolio Management and their importance in achieving financial goals.

- Learn about Markowitz's Portfolio Theory and its relevance in creating a well-diversified investment portfolio.

- Analyze the Market Efficiency Theory, Arbitrage Pricing Theory, and Capital Asset Pricing Model and their implications for stock investment strategies.

Principles of Taxation:

- Understand taxation's basic concept and purpose, its history, and its evolution in different societies and economic systems.

- Explore the fundamental principles of taxation and learn how they shape tax policy and practice.

- Analyze the nature of progressive and regressive taxes and their impact on income distribution and social justice.

- Distinguish between direct and indirect taxes and explore their respective characteristics, advantages, and disadvantages.

- Identify direct and indirect taxes and their application in other countries and economic systems.

- Evaluate the impact of taxation on investment decisions, including the role of tax in shaping savings, investment, and capital allocation.

Investment Risk Management:

- Describe the nature of investment risk and its potential impact on investment outcomes.

- Identify and differentiate between the types of investment risks, such as market risk, credit risk, and liquidity risk.

- Explain the nature and process of risk management, including risk identification, risk assessment, and risk mitigation.

- Analyze the nature of a risk mitigation plan and identify the key components that make it effective.

- Evaluate a range of risk mitigation methods used in investments, including diversification, asset allocation, and use of derivatives.

- Examine the concept of hedging in investments, including hedging strategies and the use of futures and options for speculation and arbitrage.

Accreditation

All MSBM courses are accredited by the relevant partners and awarding bodies. Please refer to MSBM accreditation in about us for more details.Entry Requirements

There are no strict entry requirements for this course. Work experience will be added advantage to understanding the content of the course.The certificate is designed to enhance the learner's knowledge in the field. This certificate is for everyone eager to know more and get updated on current ideas in their respective field. We recommend this certificate for the following audience.

- CEO, CFO, Director, Manager, Supervisor

- Investment Analyst

- Portfolio Manager

- Financial Advisor

- Risk Manager

- Equity Research Analyst

- Investment Banker

- Fund Manager

- Asset Manager

- Wealth Manager

- Financial Consultant

Course Modules

The Advanced Professional Certificate in Investment Analysis aims to equip the learner with the key concepts of financial instruments traded on the market. The course will enable the learner to analyze different financial statements using the tools and methods of financial analysis and generate and evaluate different financial investment options. The learner will be equipped with the knowledge and skills to manage the investment portfolio.

-

VIDEO - Course Structure and Assessment Guidelines

Watch this video to gain further insight.

-

Navigating the MSBM Study Portal

Watch this video to gain further insight.

-

Interacting with Lectures/Learning Components

Watch this video to gain further insight.

-

Introduction to Investment Analysis

Self-paced pre-recorded learning content on this topic.

-

CASE STUDY - Inflation Considerations for Stock and Bond Investments

Downloadable material to advance your understanding of this module.

-

Analysis of Bonds, Forward and Futures

Self-paced pre-recorded learning content on this topic.

-

Stock Investment and Portfolio Management

Self-paced pre-recorded learning content on this topic.

-

CASE STUDY - Anglian Water Investment Portfolio

Watch this video to gain further insight.

-

Principles of Taxation

Self-paced pre-recorded learning content on this topic.

-

Investment Risk Management

Self-paced pre-recorded learning content on this topic.

-

Investment Analysis

Put your knowledge to the test with this quiz. Read each question carefully and choose the response that you feel is correct.

The Advanced Professional Certificate in Investment Analysis aims to equip the learner with the key concepts of financial instruments traded on the market.

The course will enable the learner to analyze different financial statements using the tools and methods of financial analysis and generate and evaluate different financial investment options. The learner will be equipped with the knowledge and skills to manage the investment portfolio.

Learning Outcomes

Introduction to Investment Analysis:

- Understand the difference between direct and indirect investments and the advantages and disadvantages of each in terms of risk and return.

- Learn the key measures of return and risk used in investment analysis, including the expected return, standard deviation, and Sharpe ratio, and how to calculate them.

- Explore the determinants of the required rate of return, including risk-free rate, market risk premium, and beta, and understand how these factors affect investment decisions.

- Gain a solid understanding of correlation and coefficient of determination and how they are used to measure the strength and direction of the relationship between two assets.

- Dive into the concept of returns, including the different types of returns, such as capital gains, dividends, and interest, and how they impact investment analysis and decision-making.

- Discover the effect of diversification on investment risk and how to construct a diversified portfolio that balances risk and return.

Analysis of Bonds, Forward and Futures:

- Understand the fundamentals of bond market analysis, including the different types of bonds and their characteristics.

- Learn about the advantages and disadvantages of investing in bonds and how to assess whether they are the right investment option for you.

- Gain in-depth knowledge of the various classifications of bonds, such as government, corporate, and municipal bonds, and how they differ from each other.

- Discover the importance of macro-level analysis in bond investment, including factors such as interest rates, inflation, and economic indicators.

- Learn about the concept of options and futures and the role they play in financial markets and investment strategies.

- Understand the concept and uses of swaps, including interest rate swaps and currency swaps, and how they can be used to manage risk and optimize investment returns.

Stock Investment and Portfolio Management:

- Understand the concepts and applications of Economic, Technical and Fundamental Analysis in stock investment.

- Explain the Industry Life Cycle model and its impact on portfolio management decisions.

- Explore and analyze the Tools of Technical Analysis used in stock investment.

- Identify the Objectives of Portfolio Management and their importance in achieving financial goals.

- Learn about Markowitz's Portfolio Theory and its relevance in creating a well-diversified investment portfolio.

- Analyze the Market Efficiency Theory, Arbitrage Pricing Theory, and Capital Asset Pricing Model and their implications for stock investment strategies.

Principles of Taxation:

- Understand taxation's basic concept and purpose, its history, and its evolution in different societies and economic systems.

- Explore the fundamental principles of taxation and learn how they shape tax policy and practice.

- Analyze the nature of progressive and regressive taxes and their impact on income distribution and social justice.

- Distinguish between direct and indirect taxes and explore their respective characteristics, advantages, and disadvantages.

- Identify direct and indirect taxes and their application in other countries and economic systems.

- Evaluate the impact of taxation on investment decisions, including the role of tax in shaping savings, investment, and capital allocation.

Investment Risk Management:

- Describe the nature of investment risk and its potential impact on investment outcomes.

- Identify and differentiate between the types of investment risks, such as market risk, credit risk, and liquidity risk.

- Explain the nature and process of risk management, including risk identification, risk assessment, and risk mitigation.

- Analyze the nature of a risk mitigation plan and identify the key components that make it effective.

- Evaluate a range of risk mitigation methods used in investments, including diversification, asset allocation, and use of derivatives.

- Examine the concept of hedging in investments, including hedging strategies and the use of futures and options for speculation and arbitrage.

Investment Analysis is a comprehensive course that provides students with the essential skills and knowledge required to evaluate and manage investments. The course explores the fundamental principles of investment analysis, including asset valuation, portfolio diversification, risk management, and market analysis. Students will learn how to apply these principles to a variety of investment scenarios, including equities, fixed income securities, and alternative investments.

In addition to theoretical concepts, the course emphasizes practical skills development, such as financial statement analysis, ratio analysis, and technical analysis. Students will also learn how to use financial tools and software to evaluate investment opportunities and assess portfolio performance. By the end of the course, students will have a solid foundation in investment analysis and be able to make informed investment decisions that align with their investment objectives and risk tolerance.

The Advanced Professional Certificate in Investment Analysis aims to equip the learner with the key concepts of financial instruments traded on the market. The course will enable the learner to analyze different financial statements using the tools and methods of financial analysis and generate and evaluate different financial investment options. The learner will be equipped with the knowledge and skills to manage the investment portfolio.

-

VIDEO - Course Structure and Assessment Guidelines

Watch this video to gain further insight.

-

Navigating the MSBM Study Portal

Watch this video to gain further insight.

-

Interacting with Lectures/Learning Components

Watch this video to gain further insight.

-

Introduction to Investment Analysis

Self-paced pre-recorded learning content on this topic.

-

CASE STUDY - Inflation Considerations for Stock and Bond Investments

Downloadable material to advance your understanding of this module.

-

Analysis of Bonds, Forward and Futures

Self-paced pre-recorded learning content on this topic.

-

Stock Investment and Portfolio Management

Self-paced pre-recorded learning content on this topic.

-

CASE STUDY - Anglian Water Investment Portfolio

Watch this video to gain further insight.

-

Principles of Taxation

Self-paced pre-recorded learning content on this topic.

-

Investment Risk Management

Self-paced pre-recorded learning content on this topic.

-

Investment Analysis

Put your knowledge to the test with this quiz. Read each question carefully and choose the response that you feel is correct.

The certificate is designed to enhance the learner's knowledge in the field. This certificate is for everyone eager to know more and get updated on current ideas in their respective field. We recommend this certificate for the following audience.

- CEO, CFO, Director, Manager, Supervisor

- Investment Analyst

- Portfolio Manager

- Financial Advisor

- Risk Manager

- Equity Research Analyst

- Investment Banker

- Fund Manager

- Asset Manager

- Wealth Manager

- Financial Consultant

Single Course Purchase

(Buy Lifetime Access)What you will get:

- Access to this course.

- Access to library.

Unlimited APCC Subscription

What you will get:

- Access to this course.

- Access to additional courses.

- Access to library.

- Digital certificates.

Unlimited APCC & PCC Subscription

What you will get:

- Access to this course.

- Access to additional courses.

- Access to library.

- Digital certificates.

Training 5 or more people?

Get your team access to 16,000+ top MSBM courses anytime, anywhere.

Try MSBM for BusinessAll our programmes include:

Real-world case studies and Testimonials

- Master the in-demand tech skills with our real-world projects

- Get experience with industry-leading companies

Excellent learner support and guidance provided

- Get help and guidance from our tutors when you need it

- Our tutors will help keep you motivated and inspired to reach your goals.

Exclusive access to our professional community

- Enjoy exclusive access to a host of resources curated by industry experts

- Connect with professionals, thought leaders, and innovators in your field and expand your network.

Highly adaptable and flexible learning model

- Access our learning materials and resources from anywhere, at any time that suits you.

- With our self-paced learning, you can accelerate or slow down your learning process to fit your needs.

Unlock your potential

Upskill, reskill or pursue a passion with short courses across every subject, whether you’re a beginner or already an expert.

Choose a better way to learn

Bring the right people and information together in channels.

Why MSBM?

Learn at your pace

Self-study online courses are available 24/7 so you can learn at your pace. This approach offers students who choose distance learning the flexibility to combine studies with work or other commitments.

Exclusive study groups

Our learners may be paired into study groups to help them keep tabs on group assignments and projects.

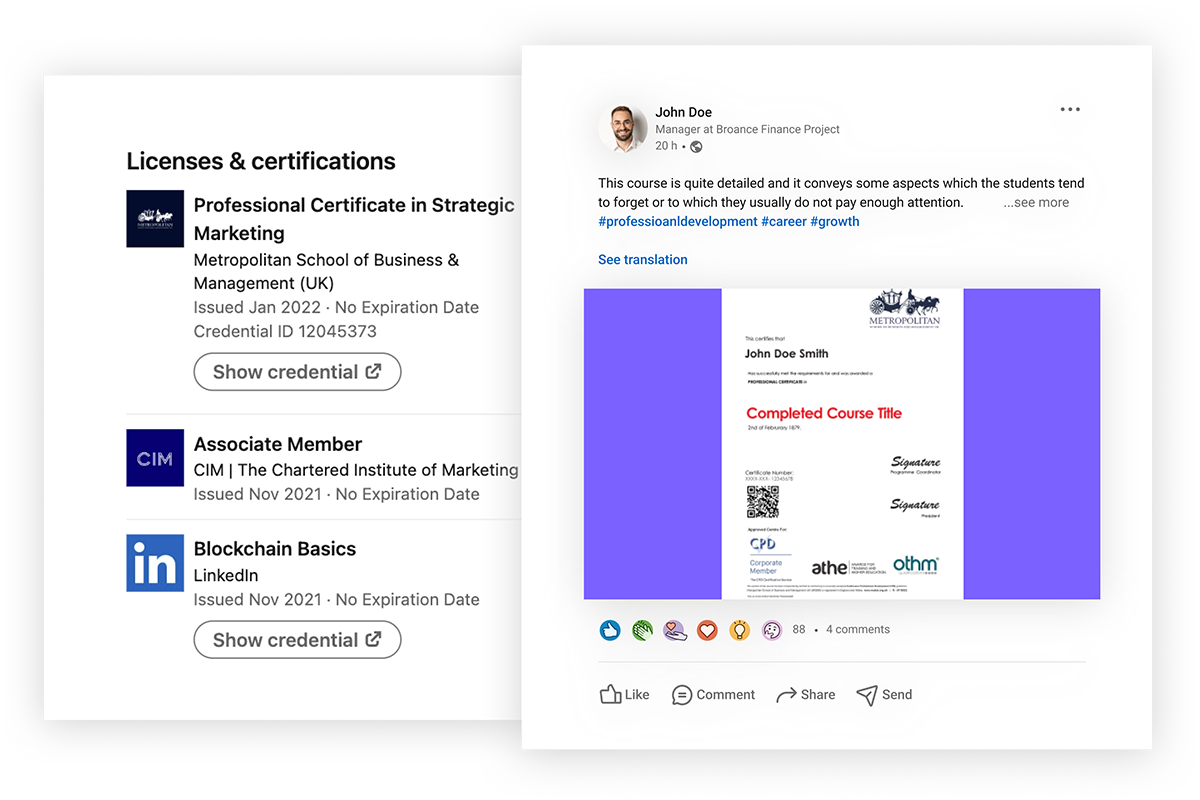

Identity verification

Our certificates and ID cards are verifiable and are strong proof of learnership.

Accredited Courses

Our programmes are fully accredited by relevant awarding bodies all over the world.

A community of true professionals

You’ll be able to connect with other learners throughout your learning journey.

Unlimited Tutor Support

Our learners get unlimited support from our academic team.

Why MSBM?

Learn at your pace

Self-study online courses are available 24/7 so you can learn at your pace. This approach offers students who choose distance learning the flexibility to combine studies with work or other commitments.

Exclusive study groups

Our learners may be paired into study groups to help them keep tabs on group assignments and projects.

Identity verification

Our certificates and ID cards are verifiable and are strong proof of learnership.

Accredited Courses

Our programmes are fully accredited by relevant awarding bodies all over the world.

A community of true professionals

You’ll be able to connect with other learners throughout your learning journey.

Unlimited Tutor Support

Our learners get unlimited support from our academic team.

Earn certificates to add to your LinkedIn profile.

Upskill, reskill or pursue a passion with short courses across every subject, whether you’re a beginner or already an expert.

Learn fast

Online courses with compact learning chapters enable you to learn business skills faster than ever.

Study Online

Get access to online study materials. All courses are 100% online and self-paced.

Global community

No conventional requirements needed, our courses are open to all ages, professions and citizenship.

2,295,174

Learners' Community1,593

Courses237

Nationalities23,291

OrganisationsLearn on your time

Watch bite-sized videos or in-depth courses.

Get Certified

Earn certificates to add to your LinkedIn profile.

Prove your skills

Earn certificates to add to your LinkedIn profile.