Advanced Professional Certificate in Anti Money Laundering in United Arab Emirates 2024

Average Completion Time

1 Month

Accreditation

5 CPD Hours

Level

Advanced

Start Time

Anytime

100% Online

Study online with ease.

Unlimited Access

24/7 unlimited access with pre-recorded lectures.

Low Fees

Our fees are low and easy to pay online.

Advanced Professional Certificate Courses

These are short online certificate courses of a more advanced nature designed to help you develop professionally and achieve your career goals, while you earn a professional certificate which qualifies you for the appropriate continuous professional development (CPD).

The course introduces the concept of money laundering and differentiates it from other forms of financial crimes so that the learner can effectively manage the financial transactions and be alerted of any suspicious activity. The course also equips the learner to understand different ways people launder money, strategies that the regulators use to counter the same, and a detailed compliance regime.

01. Money Laundering Concepts, Methods and Impact;

- Understand the concept and evolution of money laundering.

- Identify the three stages of money laundering.

- Understand different methods used in money laundering.

- Measure the impact of money laundering on economic growth.

- Understand the structure of the UK anti-money laundering system.

- Identify the main rules and regulations governing the UK anti-money laundering system.

- Understand the role of the financial conduct authority and other UK regulatory bodies.

- Understand the structure of the US anti-money laundering system.

- Identify the main rules and regulations governing the US anti-money laundering system.

- Understand the role of the FinCEN and other US regulatory bodies.

- Define the global framework of anti-money laundering.

- Reflect on the European Union and the United Nations anti-money laundering efforts.

- Understand the role of the Financial Action Task Force.

- Understand the role of anti-money laundering strategies.

- Determine the most influential entities in shaping anti-money laundering strategies.

- Understand the principle of a risk-based approach.

- Identify common anti-money laundering program deficiencies.

- Identify the foundational elements of anti-money laundering programs.

- Determine various tools used to reduce money laundering risks.

- Understand landmark anti-money laundering cases.

- Reflect on the consequences of a failed anti-money laundering strategy.

- Reflect on the consequences of a successful anti-money laundering strategy.

- Identify major money laundering red flags.

The module discusses the nature of money laundering and differentiates it from other financial crimes. The learner will be able to understand the different ways money is laundered and the tools that are developed and enforced to prevent and expose such ways. In addition, we will also discuss the national and international relevant legislation regarding the anti-money laundering regime.

-

VIDEO - Course Structure and Assessment Guidelines

Watch this video to gain further insight.

-

Navigating the MSBM Study Portal

Watch this video to gain further insight.

-

Interacting with Lectures/Learning Components

Watch this video to gain further insight.

-

Money Laundering Concepts, Methods and Impact

This lecture explains the concept and evolution of money laundering along with the identification of three stages and methods used in each stage of money laundering. It will also explore the impact of money laundering on the general economy of any constituency.

-

Thought Reflection - Concepts, Methods and Impact

Share your views on topical issues within the course to be reviewed by your lecturer.

-

National and International Regulatory Landscape of AML

This lecture discusses the national and international policy and regulatory regime in place to identify and counter money laundering.

-

Thought Reflection - Regulatory Landscape of AML

Share your views on topical issues within the course to be reviewed by your lecturer.

-

Anti-money Laundering Strategies and Tools

This lecture explores different tools and strategies mandated and utilized in an effective money laundering programme achieving high compliance and reducing AML related risks.

-

Anti-money Laundering Cases

This lecture comprehensively explores practical money laundering cases around the globe to highlight the methods used to launder money, strategies and tools to detect and prevent the damages and the final verdict on each of the cases.

-

Tell us about your learning

Share your views on topical issues within the course to be reviewed by your lecturer.

-

QUIZ - Anti Money Laundering: Concepts, Compliance and Strategies

Put your knowledge to the test with this quiz. Read each question carefully and choose the response that you feel is correct.

There are no strict entry requirements for this course. Work experience will be added advantage to understanding the content of the course.

The certificate is designed to enhance the knowledge of the learner in the field. This certificate is for everyone eager to know more and gets updated on current ideas in the respective field. We recommend this certificate for the following audience.

- CEO, Director, Manager, Supervisor

- AML Compliant Manager/Executive/Officer

- Head of Compliance

- Head of Audit

- Corporate Risk Manager

- AML Policy Advisory Analyst

AED 600 AED 1,080

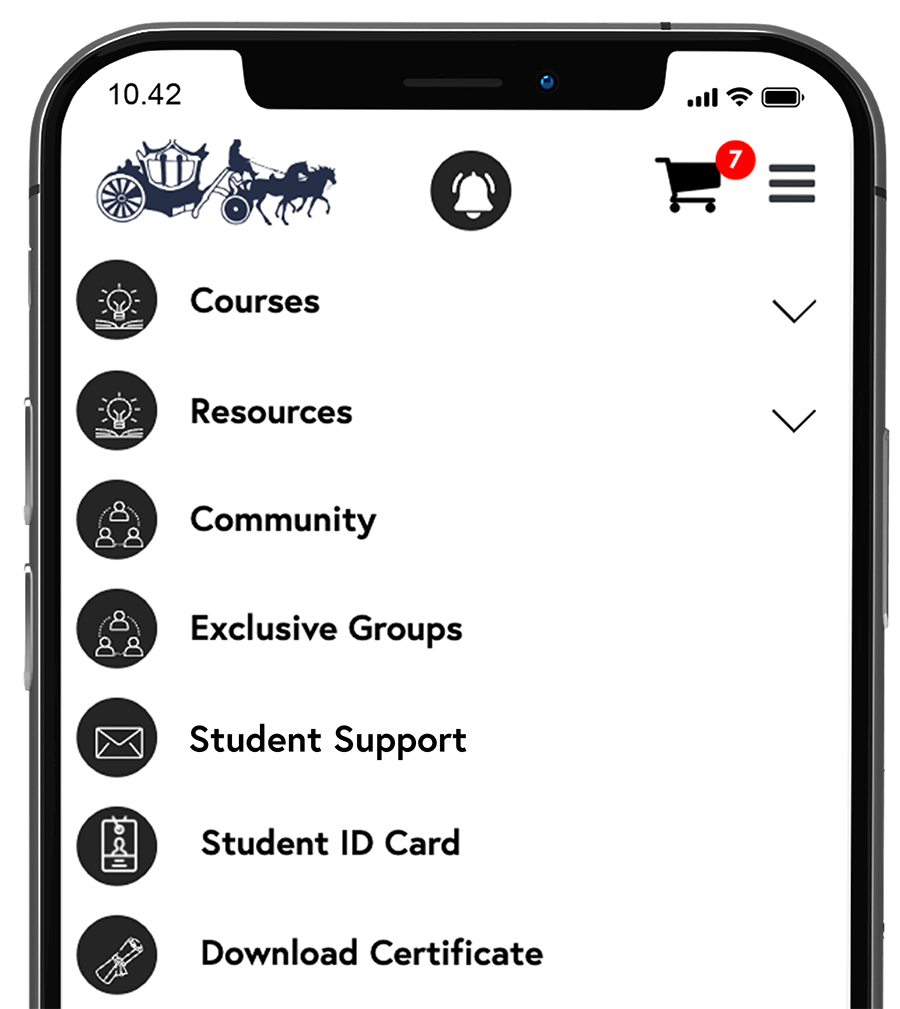

- Access to this course.

- Access to learning community.

- Access to library.

- Learn at your own pace.

- Tests to boost your learning.

- Digital certificate when eligible.

All our programmes include:

Real-world case studies and Testimonials

With real-world projects and immersive content built in partnership with top-tier companies, you’ll master the tech skills companies want.

Excellent learner support

Our knowledgeable mentors guide your learning and are focused on answering your questions, motivating you and keeping you on track.

Exclusive access to our professional community

Our knowledgeable mentors guide your learning and are focused on answering your questions, motivating you and keeping you on track.

Flexible learning model

Tailor a learning plan that fits your busy life. Learn at your own pace and reach your personal goals on the schedule that works best for you.

Unlock your potential

Upskill, reskill or pursue a passion with short courses across every subject, whether you’re a beginner or already an expert.

Choose a better way to learn

Bring the right people and information together in channels.

Why MSBM?

Learn at your pace

Self-study online courses are available 24/7 so you can learn at your pace. This approach offers students who choose distance learning the flexibility to combine studies with work or other commitments.

Exclusive study groups

Our learners may be paired into study groups to help them keep tabs on group assignments and projects.

Identity verification

Our certificates and ID cards are verifiable and are strong proof of learnership.

Accredited Courses

Our programmes are fully accredited by relevant awarding bodies all over the world.

A community of true professionals

You’ll be able to connect with other learners throughout your learning journey.

Unlimited Tutor Support

Our learners get unlimited support from our academic team.

Why MSBM?

Learn at your pace

Self-study online courses are available 24/7 so you can learn at your pace. This approach offers students who choose distance learning the flexibility to combine studies with work or other commitments.

Exclusive study groups

Our learners may be paired into study groups to help them keep tabs on group assignments and projects.

Identity verification

Our certificates and ID cards are verifiable and are strong proof of learnership.

Accredited Courses

Our programmes are fully accredited by relevant awarding bodies all over the world.

A community of true professionals

You’ll be able to connect with other learners throughout your learning journey.

Unlimited Tutor Support

Our learners get unlimited support from our academic team.

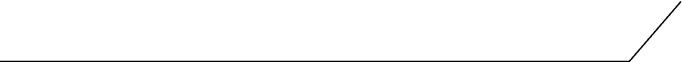

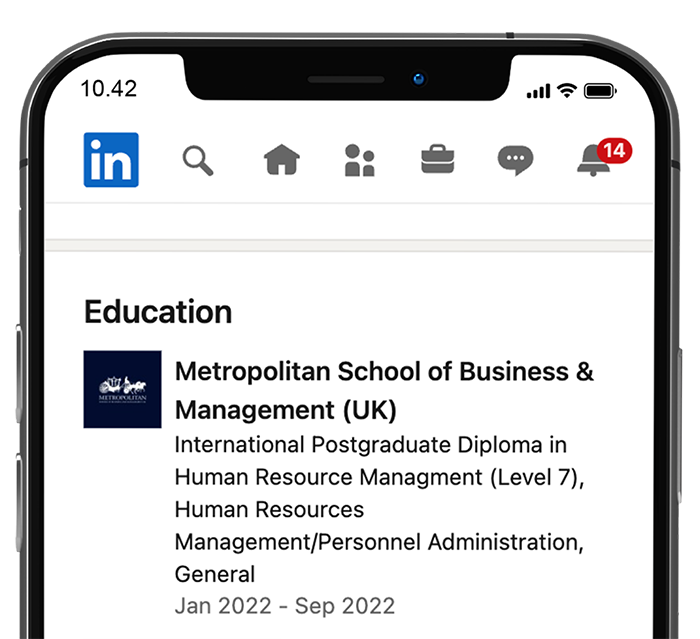

Earn certificates to add to your LinkedIn profile.

Upskill, reskill or pursue a passion with short courses across every subject, whether you’re a beginner or already an expert.

Learn fast

Online courses with compact learning chapters enable you to learn business skills faster than ever.

Study Online

Get access to online study materials. All courses are 100% online and self-paced.

Global community

No conventional requirements needed, our courses are open to all ages, professions and citizenship.663,064

Learners1,586

Courses237

Nationalities23,008

OrganisationsLearn on your time

Watch bite-sized videos or in-depth courses.

Get Certified

Earn certificates to add to your LinkedIn profile.

Prove your skills

Earn certificates to add to your LinkedIn profile.

Reviews

Reviews