Advanced Professional Certificate Course in International Corporate Finance in In-Nadur 2024

Average Completion Time

1 Month

Accreditation

5 CPD Hours

Level

Advanced

Start Time

Anytime

100% Online

Study online with ease.

Unlimited Access

24/7 unlimited access with pre-recorded lectures.

Low Fees

Our fees are low and easy to pay online.

Advanced Professional Certificate Courses

These are short online certificate courses of a more advanced nature designed to help you develop professionally and achieve your career goals, while you earn a professional certificate which qualifies you for the appropriate continuous professional development (CPD).

This Advanced Professional Certificate Course in International Corporate Finance provides a comprehensive overview of global financial dynamics, including multinational corporations, risk management, and global financial institutions. Explore foreign exchange markets, assess exchange rate systems, and delve into interest rate parity and purchasing power parity. Understand international cash management, portfolio investment, and equity sourcing strategies. Additionally, gain insights into international trade financing instruments, including letters of credit, bank guarantees, and factoring.

This Advanced Professional Certificate Course in International Corporate Finance offers a comprehensive understanding of the global financial environment, covering topics such as multinational corporations, risk management, and global financial institutions. Participants will delve into managing foreign exchange risk, exploring exchange rate systems, and understanding foreign exchange exposure. The course also covers arbitrage, interest rate parity, purchasing power parity, international investment, and financing complexities. Additionally, participants will gain insights into international trade financing, including instruments like letters of credit, bank guarantees, and factoring in facilitating global commerce.

After the successful completion of this course, you will understand the following;

Global Financial Environment

- Explain the Growing Importance of International Finance and its Significance in the Global Economy.

- Discuss the Concept of a Multinational Corporation and Its Role in International Finance.

- Analyse the Risks Involved in International Finance and the Strategies Used to Manage Them.

- Explore the Principles of Global Finance Including the Risk-return Trade-off, Market Imperfections, and the Portfolio Effect.

- Examine the Role of Global Financial Institutions Such as the IMF, World Bank, and International Finance Corporation (IFC) in the Global Financial System.

MANAGING FOREIGN EXCHANGE RISK AND EXPOSURE

- Understand the Concept of Exchange Rate Determination and Identify the Key Factors that Influence it in the Foreign Exchange Market.

- Compare and Contrast the Features and Characteristics of the Spotted Foreign Exchange Market and the Forward Foreign Exchange Market.

- Evaluate the Advantages and Disadvantages of Floating Exchange Rates as a System for Determining Currency Values in the Global Economy.

- Explain the Concept of Fixed Exchange Rates Including the Mechanisms and Policies Used to Maintain them by Central Banks and Governments.

- Differentiate between Controlled Exchange Rates and Freely Floating Exchange Rates and Analyse the Impact of Government Intervention on Currency Values and Economic Stability.

- Explore the Concept of Foreign Exchange Exposure and Risk and Assess the Potential Implications and Challenges it Poses for Businesses Operating in International Markets.

Arbitrage and Purchasing Power ParityArbitrage and Purchasing and Power Parity

- Understand the Concept of Interest Rate Parity and its Implications for Financial Markets.

- Explain the Interest Rate Arbitrage Theorem and How it is Used to Exploit Interest Rate Differentials in International Markets.

- Analyse Uncovered Interest Rate Arbitrage and the Carry Trade as Investment and Borrowing Strategies in Response to Interest Rate Differentials.

- Explore the Covered Interest-parity Condition and its Significance in Determining the Relationship Between Interest Rates and Exchange Rates.

- Discuss Purchasing Power Parity (PPP) and its Various Forms Including Absolute and Relative PPP As Well As the Practical Importance of PPP in Understanding Exchange Rate Dynamics.

International Investment and Financing

- Understand the Objectives of Cash Management and its Importance in Effectively Managing an Organisation's Cash Flows.

- Explore the Motives Behind Holding Cash and How it Impacts Liquidity Management in Both Domestic and International Contexts.

- Analyse the Complexities Involved in International Cash Management Including Factors Such as Currency Risk, Cross-border Transactions and Regulatory Requirements.

- Assess the Risks Associated with International Cash Management and Identify Strategies to Mitigate these Risks Such as Hedging, Diversification and Cash Flow Forecasting.

- Examine the Concept of Portfolio Investment and its Distinction from Foreign Direct Investment, Highlighting the Benefits and Risks of Engaging in Foreign Portfolio Investment.

- Evaluate the Benefits and Challenges of Sourcing Equity Globally and Design Strategies for Raising Equity in Foreign Markets Including the Use of American Depository Receipts (ADRS) and Depositary Receipts.

International Trade Financing

- Explain the Concept of International Trade Financing and its Significance in Facilitating Global Commerce.

- Describe Various Trade Financing Instruments Used in International Trade Transactions.

- Analyse the Process of Issuing and Utilising a Letter of Credit for International Trade Financing.

- Compare and Contrast Different Types of Letters of Credit and their Specific Characteristics.

- Differentiate Between Bank Guarantee and Letter of Credit as Forms of Trade Financing and their Respective Applications.

- Explore the Concept of Factoring and its Role in International Trade Financing Including Benefits and Considerations for Businesses.

This Advanced Professional Certificate Course in International Corporate Finance comprehensively explores global financial dynamics. Understand the importance of international finance, analyze risks, and explore principles such as risk-return trade-offs and the role of global financial institutions. Delve into managing foreign exchange risk, evaluating exchange rate systems, and examining exposure challenges for businesses operating globally. Gain insights into interest rate parity, arbitrage strategies, and purchasing power parity. Explore international investment and financing complexities, including cash management, portfolio investment, and equity sourcing in foreign markets. Additionally, understand the significance of international trade financing, covering instruments like letters of credit and factors influencing global commerce.

-

Course Structure and Assessment Guidelines

Watch this video to gain further insight.

-

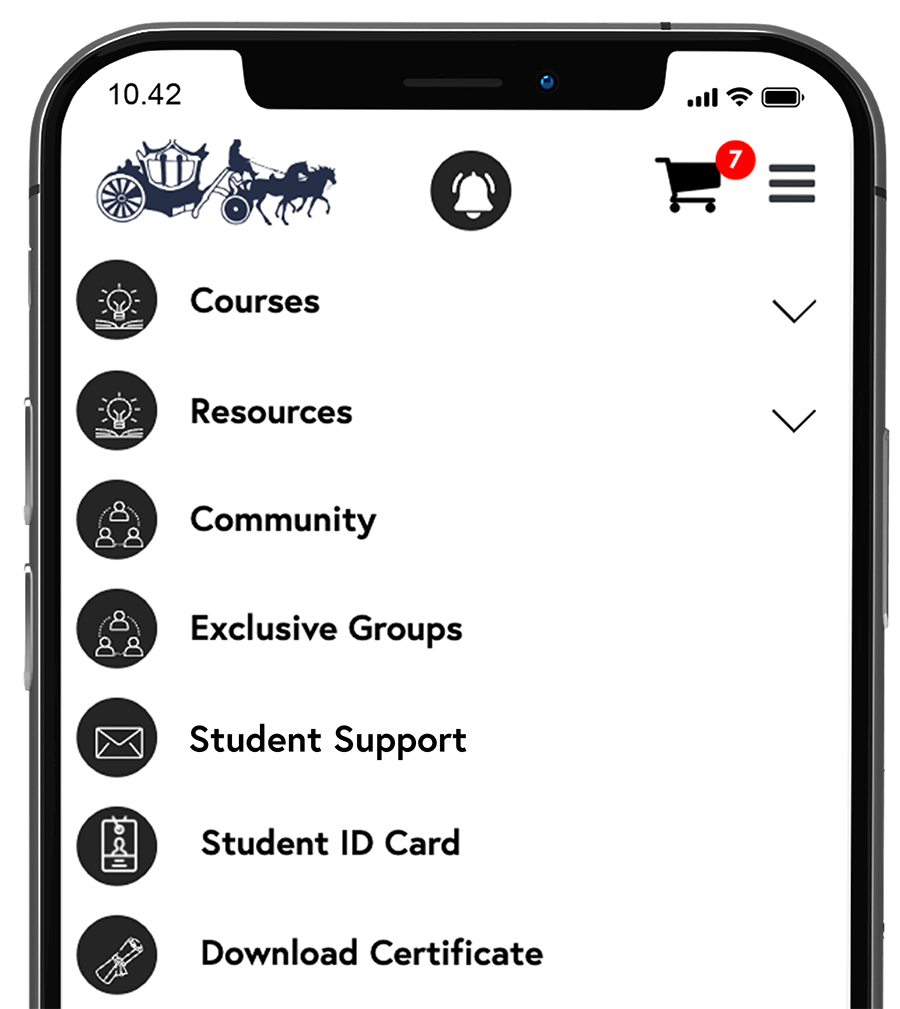

Navigating the MSBM Study Portal

Watch this video to gain further insight.

-

Interacting with Lectures/Learning Components

Watch this video to gain further insight.

-

Managing Foreign Exchange Risk and Exposure

Self-paced pre-recorded learning content on this topic.

-

International Investment and Financing

Self-paced pre-recorded learning content on this topic.

-

International Trade Financing

Self-paced pre-recorded learning content on this topic.

-

Global Financial Environment

Self-paced pre-recorded learning content on this topic.

-

Arbitrage and Purchasing Power Parity

Self-paced pre-recorded learning content on this topic.

-

QUIZ- Corporate International Finance

Put your knowledge to the test with this quiz. Read each question carefully and choose the response that you feel is correct.

The certificate is designed to enhance the learner's knowledge in the field. This certificate is for everyone eager to know more and get updated on current ideas in their respective field. We recommend this certificate for the following audience.

- Financial Managers

- Corporate Treasurers

- International Business Executives

- Investment Analysts

- Risk Managers

- Finance Professionals

- Currency Traders

- Multinational Corporations

- Banking Professionals

- Trade Finance Specialists

- Financial Consultants

- Government Officials

- Academics in Finance

- International Trade Professionals

- Global Business Strategists

- Business Development Managers

EUR 153 EUR 275

- Access to this course.

- Access to learning community.

- Access to library.

- Learn at your own pace.

- Tests to boost your learning.

- Digital certificate when eligible.

All our programmes include:

Real-world case studies and Testimonials

With real-world projects and immersive content built in partnership with top-tier companies, you’ll master the tech skills companies want.

Excellent learner support

Our knowledgeable mentors guide your learning and are focused on answering your questions, motivating you and keeping you on track.

Exclusive access to our professional community

Our knowledgeable mentors guide your learning and are focused on answering your questions, motivating you and keeping you on track.

Flexible learning model

Tailor a learning plan that fits your busy life. Learn at your own pace and reach your personal goals on the schedule that works best for you.

Unlock your potential

Upskill, reskill or pursue a passion with short courses across every subject, whether you’re a beginner or already an expert.

Choose a better way to learn

Bring the right people and information together in channels.

Why MSBM?

Learn at your pace

Self-study online courses are available 24/7 so you can learn at your pace. This approach offers students who choose distance learning the flexibility to combine studies with work or other commitments.

Exclusive study groups

Our learners may be paired into study groups to help them keep tabs on group assignments and projects.

Identity verification

Our certificates and ID cards are verifiable and are strong proof of learnership.

Accredited Courses

Our programmes are fully accredited by relevant awarding bodies all over the world.

A community of true professionals

You’ll be able to connect with other learners throughout your learning journey.

Unlimited Tutor Support

Our learners get unlimited support from our academic team.

Why MSBM?

Learn at your pace

Self-study online courses are available 24/7 so you can learn at your pace. This approach offers students who choose distance learning the flexibility to combine studies with work or other commitments.

Exclusive study groups

Our learners may be paired into study groups to help them keep tabs on group assignments and projects.

Identity verification

Our certificates and ID cards are verifiable and are strong proof of learnership.

Accredited Courses

Our programmes are fully accredited by relevant awarding bodies all over the world.

A community of true professionals

You’ll be able to connect with other learners throughout your learning journey.

Unlimited Tutor Support

Our learners get unlimited support from our academic team.

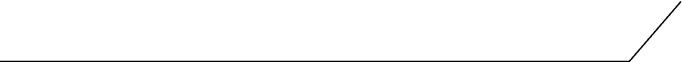

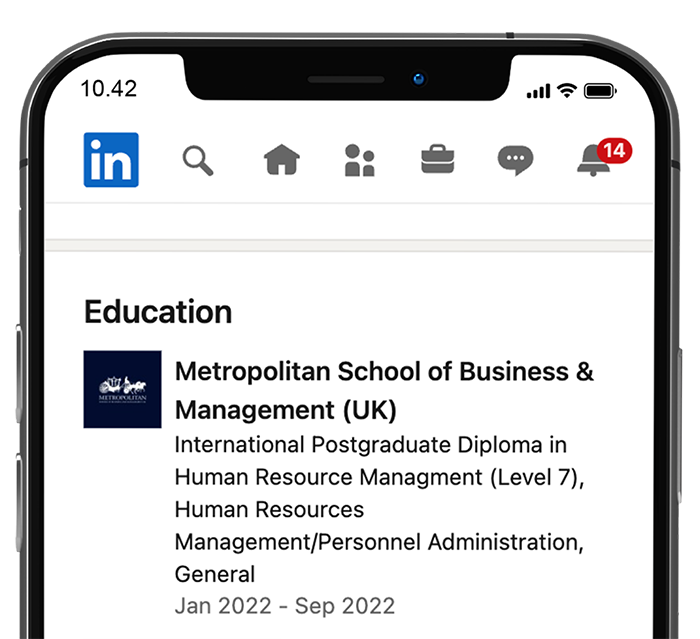

Earn certificates to add to your LinkedIn profile.

Upskill, reskill or pursue a passion with short courses across every subject, whether you’re a beginner or already an expert.

Learn fast

Online courses with compact learning chapters enable you to learn business skills faster than ever.

Study Online

Get access to online study materials. All courses are 100% online and self-paced.

Global community

No conventional requirements needed, our courses are open to all ages, professions and citizenship.662,381

Learners1,586

Courses237

Nationalities22,949

OrganisationsLearn on your time

Watch bite-sized videos or in-depth courses.

Get Certified

Earn certificates to add to your LinkedIn profile.

Prove your skills

Earn certificates to add to your LinkedIn profile.

Reviews

Reviews