Advanced Professional Certificate in Working Capital Management in Concelho de Ribeira Grande de Santiago 2024

Average Completion Time

1 Month

Accreditation

5 CPD Hours

Level

Advanced

Start Time

Anytime

100% Online

Study online with ease.

Unlimited Access

24/7 unlimited access with pre-recorded lectures.

Low Fees

Our fees are low and easy to pay online.

Advanced Professional Certificate Courses

These are short online certificate courses of a more advanced nature designed to help you develop professionally and achieve your career goals, while you earn a professional certificate which qualifies you for the appropriate continuous professional development (CPD).

After the successful completion of this course, you will understand the following;

Exploring the Concept of Working Capital Management:

- Define the concept of working capital and explain its significance in a business context.

- Classify working capital and identify its different components, including cash, inventory, accounts receivable, and accounts payable.

- Describe the working capital cycle and its various stages.

- Analyze the factors that affect the composition of working capital, such as business size, industry, and operating cycle.

- Differentiate between static and dynamic views of working capital, and explain their implications for effective management.

- Identify the determinants of working capital and explain how they impact a company's financial performance.

Understanding the Working Capital Investment Policies:

- Understand the different types of Working Capital Investment Policies including Conservative, Aggressive, Highly Aggressive, and Hedging policies

- Understand the different sources of Working Capital Finance including Spontaneous and Negotiated Sources.

- Understand the time and money concept in Working Capital Management.

- Understand the need for Working Capital and its importance in the success of a business.

- Estimation of Amount of Different Components of Current Assets and Current Liabilities:

- Learn how to estimate the number of different components of Current Assets and Current Liabilities in order to manage Working Capital effectively.

Optimizing Business Operations:

- Understanding the different aspects of Cash Management.

- Identifying the motives for Holding Cash and Marketable Securities.

- Determining the factors that impact the Optimum Cash Balance.

- Defining the objectives of trade credit.

- Evaluating the different Credit policies.

- Analyzing the various dimensions of receivable management.

- Developing strategies for effective collections from receivables.

- Understanding the different Techniques of inventory management.

- Evaluating the different Methods of inventory valuation.

Assessment of Working Capital and Lending Methods:

- Understand different methods of assessing working capital, such as operating cycle, percentage of sales, regression analysis, cash forecasting, and balance sheet methods.

- Gain knowledge about various methods of lending, including Tandon's First and Second methods and the cash budget method.

Working Capital Management is a course that focuses on the efficient management of current assets and liabilities to ensure that a company has enough liquidity to meet its short-term obligations. The course covers various topics, including the assessment of working capital, forecasting techniques, and strategies for managing inventory, accounts receivable, and accounts payable. The ultimate goal is to optimize the use of working capital while minimizing the cost of financing.

-

VIDEO - Course Structure and Assessment Guidelines

Watch this video to gain further insight.

-

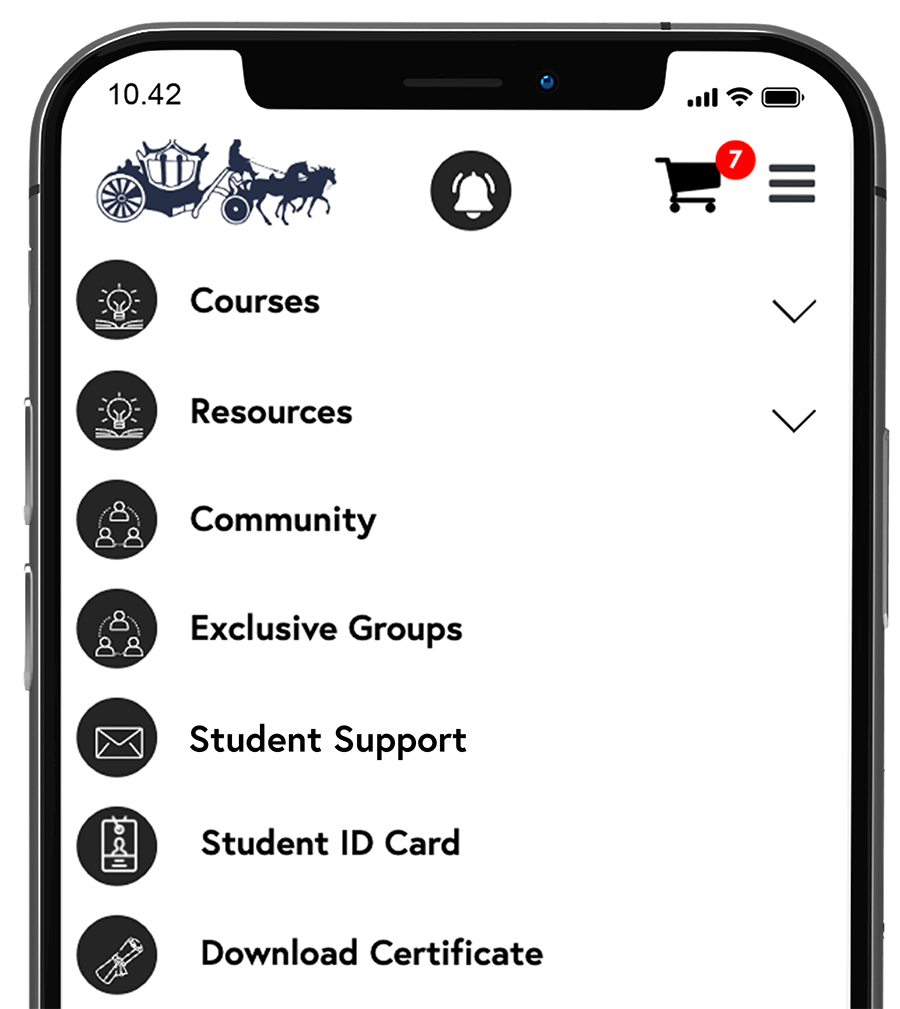

Navigating the MSBM Study Portal

Watch this video to gain further insight.

-

Interacting with Lectures/Learning Components

Watch this video to gain further insight.

-

Concepts in Cash Management, Receivables, and Inventory Management

-

Assessment of Working Capital and Lending Methods

-

Exploring the Concept of Working Capital Management

-

Understanding the Working Capital Investment Policies

-

Working Capital Management

Put your knowledge to the test with this quiz. Read each question carefully and choose the response that you feel is correct.

The certificate is designed to enhance the learner's knowledge in the field. This certificate is for everyone eager to know more and get updated on current ideas in their respective field. We recommend this certificate for the following audience.

- CEO, Director, Manager, Supervisor

- Financial Analyst

- Treasury Manager

- Credit Analyst

- Cash Management Specialist

- Working Capital Manager

- Inventory Analyst

- Accounts Receivable/Payable Manager

- Financial Planning and Analysis Manager

- Budget Analyst

- Corporate Finance Manager

CVE 16,781 CVE 30,206

- Access to this course.

- Access to learning community.

- Access to library.

- Learn at your own pace.

- Tests to boost your learning.

- Digital certificate when eligible.

All our programmes include:

Real-world case studies and Testimonials

With real-world projects and immersive content built in partnership with top-tier companies, you’ll master the tech skills companies want.

Excellent learner support

Our knowledgeable mentors guide your learning and are focused on answering your questions, motivating you and keeping you on track.

Exclusive access to our professional community

Our knowledgeable mentors guide your learning and are focused on answering your questions, motivating you and keeping you on track.

Flexible learning model

Tailor a learning plan that fits your busy life. Learn at your own pace and reach your personal goals on the schedule that works best for you.

Unlock your potential

Upskill, reskill or pursue a passion with short courses across every subject, whether you’re a beginner or already an expert.

Choose a better way to learn

Bring the right people and information together in channels.

Why MSBM?

Learn at your pace

Self-study online courses are available 24/7 so you can learn at your pace. This approach offers students who choose distance learning the flexibility to combine studies with work or other commitments.

Exclusive study groups

Our learners may be paired into study groups to help them keep tabs on group assignments and projects.

Identity verification

Our certificates and ID cards are verifiable and are strong proof of learnership.

Accredited Courses

Our programmes are fully accredited by relevant awarding bodies all over the world.

A community of true professionals

You’ll be able to connect with other learners throughout your learning journey.

Unlimited Tutor Support

Our learners get unlimited support from our academic team.

Why MSBM?

Learn at your pace

Self-study online courses are available 24/7 so you can learn at your pace. This approach offers students who choose distance learning the flexibility to combine studies with work or other commitments.

Exclusive study groups

Our learners may be paired into study groups to help them keep tabs on group assignments and projects.

Identity verification

Our certificates and ID cards are verifiable and are strong proof of learnership.

Accredited Courses

Our programmes are fully accredited by relevant awarding bodies all over the world.

A community of true professionals

You’ll be able to connect with other learners throughout your learning journey.

Unlimited Tutor Support

Our learners get unlimited support from our academic team.

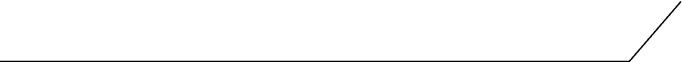

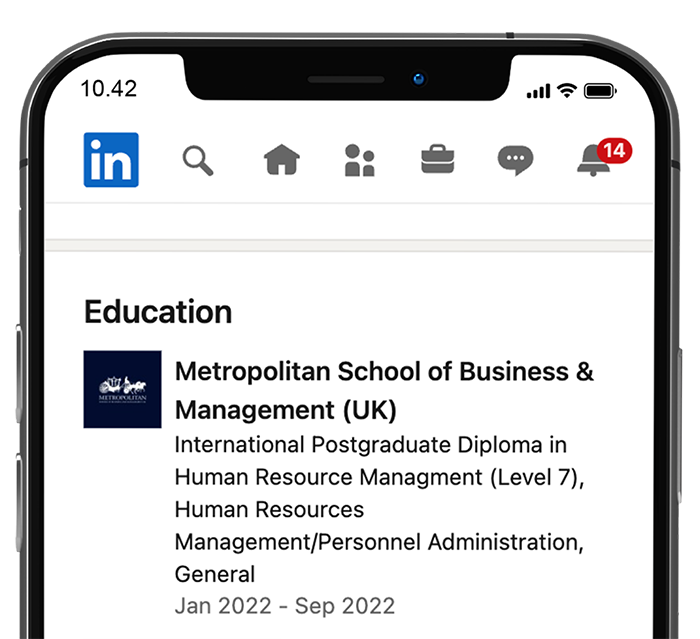

Earn certificates to add to your LinkedIn profile.

Upskill, reskill or pursue a passion with short courses across every subject, whether you’re a beginner or already an expert.

Learn fast

Online courses with compact learning chapters enable you to learn business skills faster than ever.

Study Online

Get access to online study materials. All courses are 100% online and self-paced.

Global community

No conventional requirements needed, our courses are open to all ages, professions and citizenship.662,368

Learners1,586

Courses237

Nationalities22,949

OrganisationsLearn on your time

Watch bite-sized videos or in-depth courses.

Get Certified

Earn certificates to add to your LinkedIn profile.

Prove your skills

Earn certificates to add to your LinkedIn profile.

Reviews

Reviews